Factors to Consider When Choosing a Car Loan

1. Fixed vs. Variable Interest Rates:

- Understand the difference between fixed and variable interest rates. Fixed rates remain constant throughout the loan term, providing predictable payments, while variable rates may change, affecting your monthly payments.

2. Loan Term Length:

- Consider the length of the loan term. While longer terms may result in lower monthly payments, it’s important to balance this with the total interest paid over the life of the loan.

3. Hidden Fees and Charges:

- Read the loan agreement carefully to identify any hidden fees or charges. Some lenders may impose penalties for early repayment or other unexpected costs.

4. Loan-to-Value Ratio (LTV):

- LTV ratio is the percentage of the car’s value that the lender is willing to finance. A lower LTV may lead to more favorable loan terms and interest rates.

5. Loan Origination Fees:

- Some lenders charge origination fees for processing the loan. Compare these fees among different lenders to ensure you’re getting the best overall deal.

6. Flexibility in Repayment:

- Check if the lender offers flexibility in repayment, such as the ability to make extra payments without penalties. This can be beneficial if you want to pay off the loan faster.

Additional Tips for Auto Financing

7. Gap Insurance:

- Consider purchasing gap insurance, especially if you’re financing a new car. Gap insurance covers the difference between the car’s actual value and the amount you owe in case of theft or total loss.

8. Research Manufacturer Financing Deals:

- Some car manufacturers offer special financing deals, including low-interest rates or cashback incentives. Research and compare these manufacturer deals with traditional financing options.

9. Loan Prepayment Options:

- Check if the lender allows for early loan repayment without penalties. Being able to pay off your loan ahead of schedule can save you money on interest.

10. Regularly Review Your Loan Terms:

Periodically review your loan terms and interest rates. If your credit score improves, consider refinancing to secure a lower interest rate and reduce your monthly payments.

11. Emergency Fund for Car Expenses:

Establish an emergency fund to cover unexpected car-related expenses. This can help you avoid financial strain and ensure you can continue making loan payments in challenging situations.

Economic Conditions and Car Loans

12. Interest Rate Trends:

- Stay informed about prevailing economic conditions and interest rate trends. Interest rates can fluctuate based on the overall economic climate, and securing a loan during a period of lower interest rates can result in significant savings.

13. Economic Downturns and Loan Terms:

- During economic downturns, lenders may tighten their lending criteria. Be prepared for potential changes in loan approval standards and interest rates, and consider securing financing before economic conditions worsen.

The Importance of Reading the Fine Print

14. Understanding Loan Terms:

- Carefully read and understand all aspects of the loan agreement. Pay attention to details such as the APR (Annual Percentage Rate), late payment fees, and any conditions that may impact the terms of the loan.

15. Insurance Requirements:

- Some lenders have specific insurance requirements for financed vehicles. Ensure that you understand and fulfill these requirements to avoid any complications during the loan term.

16. Penalties for Missed Payments:

- Be aware of the penalties for missed or late payments. Understanding the consequences of payment delays can help you plan and avoid unnecessary fees.

Budget Management Strategies During the Loan Term

17. Create a Car-Specific Budget:

- Develop a budget that specifically addresses your car loan, insurance, and maintenance costs. Having a dedicated budget ensures that you allocate funds appropriately and avoid financial strain.

18. Emergency Fund for Car-Related Expenses:

- In addition to a general emergency fund, consider creating a separate fund specifically for unexpected car-related expenses, such as repairs or maintenance not covered by warranty.

19. Regularly Review Your Budget:

- Regularly review and adjust your budget as needed. Changes in income, expenses, or other financial priorities may necessitate adjustments to ensure you can comfortably manage your car loan.

20. Financial Counseling Services:

If you encounter financial difficulties during the loan term, consider seeking assistance from financial counseling services. They can provide guidance on managing debt and creating a sustainable financial plan.

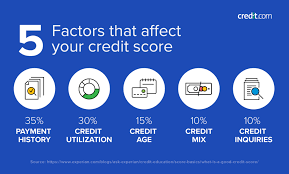

The Influence of Credit History

21. Credit Score Ranges and Interest Rates:

- Familiarize yourself with credit score ranges and their corresponding impact on interest rates. For example, excellent credit scores (above 720) often qualify for the lowest interest rates, while lower scores may result in higher rates. Check with lenders to understand how your specific score affects your loan terms.

22. Credit Monitoring Services:

- Consider using credit monitoring services to keep a vigilant eye on your credit score. These services provide regular updates and alerts for any changes in your credit report, allowing you to address potential issues promptly.

23. Credit-Building Strategies:

- If your credit history needs improvement, implement credit-building strategies. This may include timely bill payments, reducing outstanding debts, and correcting any inaccuracies on your credit report. Gradually improving your credit score can lead to more favorable car loan terms.

The Role of Down Payments

24. Down Payment Negotiation:

- Negotiate the down payment with the dealership or lender. While industry standards suggest a 20% down payment, some lenders may be flexible. A well-negotiated down payment can significantly impact your overall financing terms.

25. Impact of Down Payment on Loan-to-Value Ratio:

- Understand how your down payment affects the loan-to-value ratio (LTV). A higher down payment lowers the LTV, potentially resulting in better loan terms and reducing the risk for both you and the lender.

26. Using Trade-Ins Strategically:

- Strategically use trade-ins to your advantage. Research the value of your trade-in independently and use it as a bargaining tool. Trading in a vehicle with equity can effectively serve as a down payment.

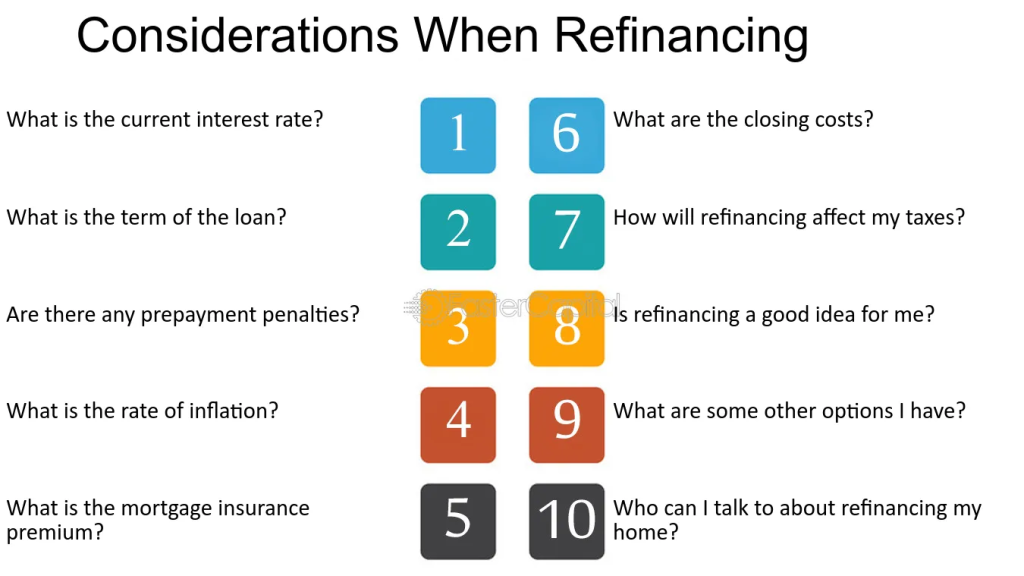

Refinancing Considerations

27. Understanding APR vs. Interest Rate:

- Differentiate between Annual Percentage Rate (APR) and the interest rate. The APR encompasses not only the interest rate but also additional fees. When refinancing, focus on reducing both the interest rate and overall APR for maximum savings.

28. Impact of Loan Term Extension:

- Be cautious when extending the loan term during refinancing. While it may reduce monthly payments, it can increase the total interest paid over the life of the loan. Strive for a balance that aligns with your financial goals.

29. Considerations for Auto Loan Refinancing:

- When considering auto loan refinancing, assess factors such as your credit score, the current market interest rates, and any prepayment penalties on your existing loan. Calculate potential savings to determine if refinancing is economically beneficial.

Technology and Car Financing

30. Digital Platforms for Loan Shopping:

- Explore digital platforms designed for car loan shopping. Some online tools aggregate loan offers, providing a comprehensive comparison of interest rates, terms, and fees. Utilize these platforms to streamline your research and decision-making process.

31. Digital Payment Security:

- Ensure the digital payment platform you choose prioritizes security. Look for features like two-factor authentication and encryption to safeguard your financial information when making online payments.

32. Mobile Apps for Loan Management:

- Take advantage of mobile apps provided by lenders for convenient loan management. These apps often allow you to monitor your loan balance, schedule payments, and receive important notifications directly from your mobile device.

Sustainable Car Ownership

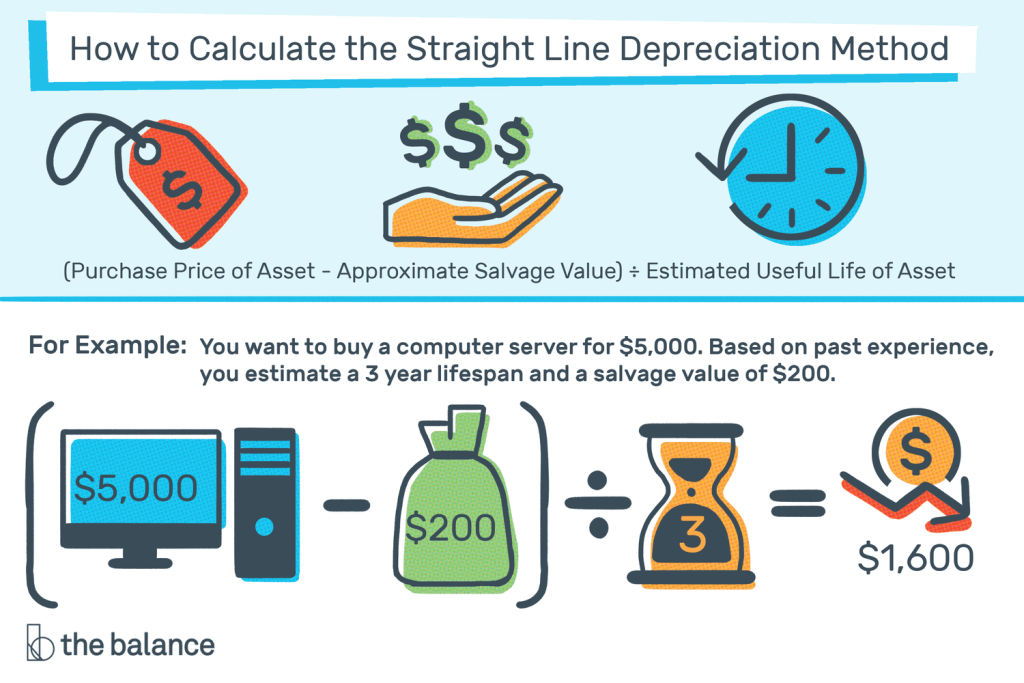

33. Budgeting for Depreciation:

- Factor in the depreciation of your vehicle when budgeting for ownership costs. Understanding the depreciation rate can help you estimate the future value of your car and plan accordingly.

34. Extended Warranty Considerations:

- Evaluate the benefits of an extended warranty, especially for used cars. While it involves an additional upfront cost, an extended warranty can provide financial protection against unexpected repairs, contributing to long-term budget stability.

35. Environmental Impact Analysis:

- Delve into the environmental impact of your chosen vehicle. Consider fuel efficiency, emissions, and the overall ecological footprint. Some regions provide incentives or tax breaks for eco-friendly vehicle choices.

Negotiating Loan Terms

36. Additional Fees and Negotiation:

- Be aware of potential additional fees beyond interest rates. Negotiate these fees with the lender. Common fees include origination fees, administrative charges, and prepayment penalties. Clear communication can lead to a more transparent and favorable loan agreement.

37. Securing a Pre-Approval:

- Consider securing a pre-approval from a lender before visiting dealerships. A pre-approval not only streamlines the car-buying process but also provides you with a clear understanding of your budget, enabling more effective negotiation.

38. Understanding the Residual Value:

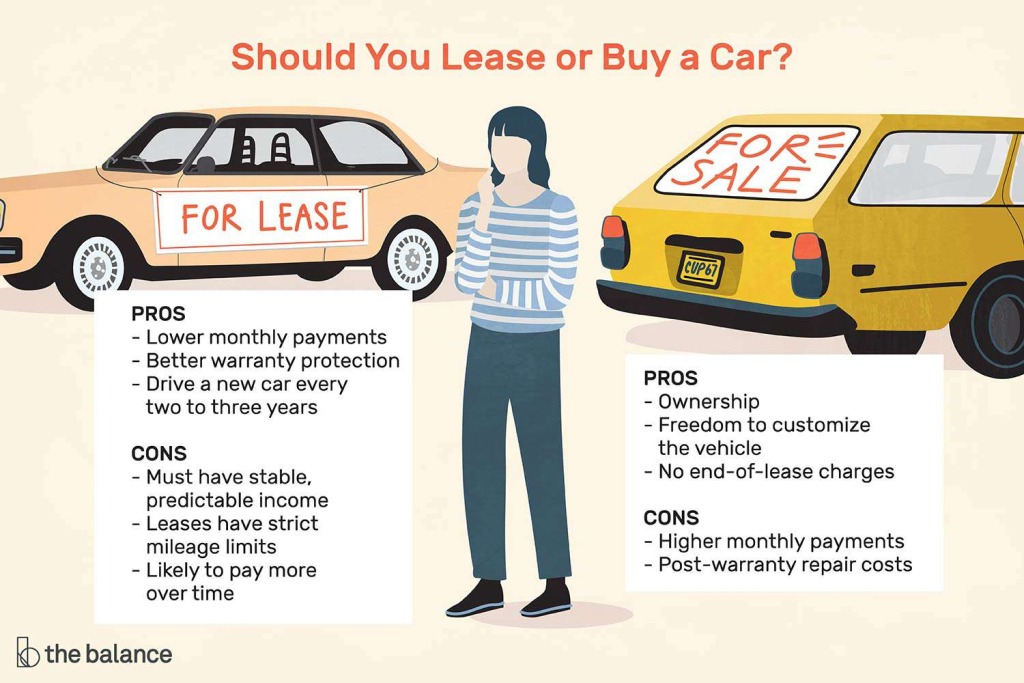

- If you’re considering leasing, understand the concept of residual value. Residual value is the estimated value of the vehicle at the end of the lease term. Negotiating a higher residual value can result in lower monthly lease payments.

Economic Conditions and Financing

39. Inflation and Interest Rates:

- Stay informed about inflation rates, as they can impact interest rates. During periods of inflation, interest rates may rise, affecting the cost of financing. Anticipating these economic changes can help you make timely financing decisions.

40. Employment Stability and Financing:

- Consider your employment stability when financing a vehicle. Economic uncertainties can impact job security, affecting your ability to make monthly payments. Evaluate your job situation and have a financial safety net in place to cover unexpected changes.

41. Local and Global Economic Trends:

- Keep an eye on both local and global economic trends. Factors such as geopolitical events, changes in currency values, and shifts in international trade can influence interest rates and overall economic stability, impacting your car loan.

Managing Unexpected Financial Challenges

42. Emergency Fund for Loan Repayment:

- Build a robust emergency fund specifically designated for loan repayment. Having this fund can provide a financial buffer in case of unexpected events, ensuring that you can continue making timely payments even during challenging times.

43. Loan Modification Options:

- In cases of financial hardship, explore loan modification options with your lender. Some lenders offer temporary relief through modified repayment plans, forbearance, or loan extensions. Open communication is key to finding mutually beneficial solutions.

44. Credit Counseling Services:

- If faced with financial challenges, consider seeking guidance from credit counseling services. These organizations can provide expert advice on debt management, budgeting, and negotiating with lenders to help you regain financial stability.

45. Insurance Protections:

- Explore insurance options that provide coverage in case of unexpected life events, such as disability or job loss. Loan protection insurance can step in to cover loan payments during challenging circumstances, offering peace of mind.

Insurance Considerations

46. Comprehensive Insurance Coverage:

- Understand the importance of comprehensive insurance coverage, especially for financed vehicles. Comprehensive coverage not only protects your vehicle in case of accidents but also provides coverage for theft, vandalism, and natural disasters.

47. Gap Insurance Explained:

- Delve into the concept of gap insurance. Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe on the loan in the event of a total loss. This coverage can be crucial, particularly during the initial depreciation period of a new car.

48. Shop Around for Insurance Rates:

- Just as you would shop around for the best loan rates, explore various insurance providers to find the most competitive rates. Different insurers may offer varying coverage options and discounts, so thorough research can result in significant savings.

Understanding Depreciation

49. Depreciation in the First Years:

- Recognize the rapid depreciation that occurs in the first few years of owning a new car. Understanding this depreciation curve is essential for aligning your financing terms with the expected value of the vehicle over time.

50. Lease-End Residual Value:

- If leasing, pay close attention to the lease-end residual value set by the leasing company. Negotiating a higher residual value at the beginning of the lease can potentially lower your monthly payments and give you more flexibility at the end of the lease term.

Technology for Informed Decision-Making

51. Auto Loan Calculators:

- Utilize online auto loan calculators to gain a deeper understanding of the financial implications of different loan terms. These tools can help you estimate monthly payments, total interest paid, and the overall cost of the loan.

52. Apps for Monitoring Vehicle Value:

- Explore mobile apps that allow you to track the depreciation and current market value of your vehicle. Having real-time information about your car’s value can be beneficial when considering trade-ins, selling, or refinancing.

53. Blockchain and Smart Contracts in Financing:

- Stay informed about emerging technologies like blockchain and smart contracts, which are gradually making their way into the financing industry. These technologies have the potential to enhance security, transparency, and efficiency in loan transactions.

54. Online Reviews and Forums:

- Leverage online reviews and forums to gain insights into the experiences of other car buyers with specific lenders and financing options. Real-world experiences can provide valuable information beyond what’s presented by lenders.

Sustainability in Car Financing

55. Green Financing Options:

- Explore green financing options if you’re considering an eco-friendly vehicle. Some financial institutions offer specialized financing for environmentally conscious choices, often with favorable terms.

56. Carbon Footprint Considerations:

- Calculate the carbon footprint of your vehicle. Some buyers prioritize eco-friendly options not only for their fuel efficiency but also for their lower environmental impact. Consider the long-term benefits of contributing to a greener environment.

Early Loan Payoff Strategies

57. Prepayment Penalties:

- Investigate whether your loan agreement includes prepayment penalties. Some lenders charge fees for paying off the loan early. Understanding these penalties is crucial when considering accelerated repayment strategies.

58. Biweekly Payment Plans:

- Explore the benefits of biweekly payment plans. By making half of your monthly payment every two weeks (equivalent to 26 half-payments or 13 full payments in a year), you can make an extra payment annually, reducing the overall interest paid and shortening the loan term.

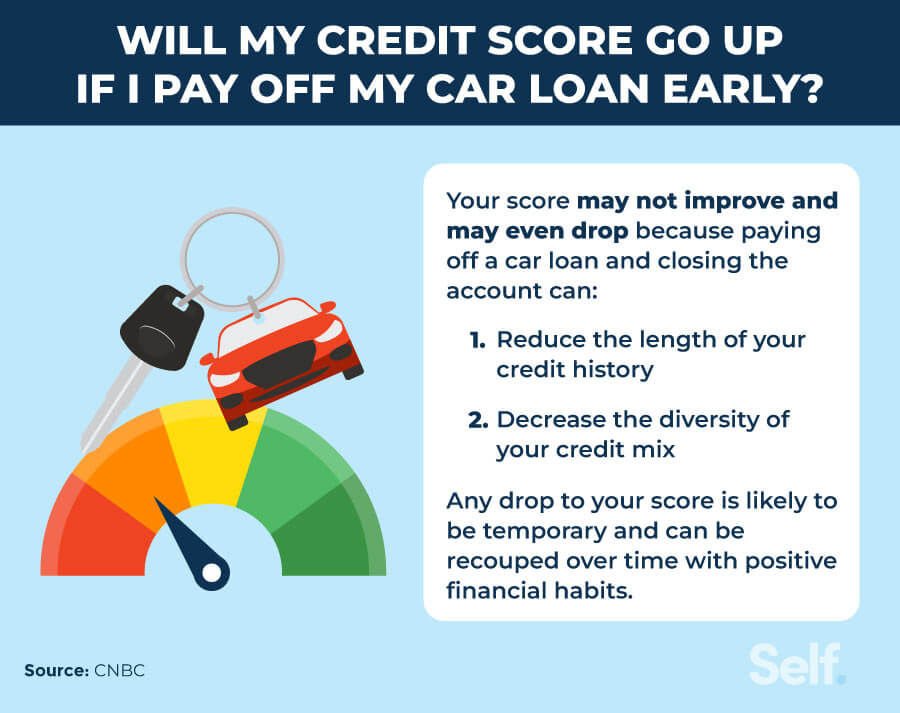

59. Effect on Credit Score:

- Understand the impact of early loan payoff on your credit score. While closing a loan can have positive effects, it’s essential to maintain a healthy mix of credit types for optimal credit score management.

Considerations for International Buyers

60. Financing for Non-Citizens:

- If you’re an international buyer, research financing options available to non-citizens. Some lenders may have specific programs for individuals without U.S. citizenship, requiring additional documentation for loan approval.

61. Currency Exchange Rates:

- Consider the implications of currency exchange rates if you’re financing a vehicle in a currency other than your home currency. Fluctuations in exchange rates can affect the overall cost of the loan.

62. Import Duties and Taxes:

- Be aware of import duties and taxes associated with bringing a financed vehicle across international borders. These costs can significantly impact the total amount you pay for the vehicle.

The Importance of Ongoing Financial Education

63. Staying Informed about Market Trends:

- Cultivate a habit of staying informed about market trends in the automotive and financial industries. Understanding how factors like interest rates, market demand, and economic conditions evolve can empower you to make timely and strategic financing decisions.

64. Continued Credit Monitoring:

- Continue monitoring your credit even after securing a car loan. Regularly checking your credit report allows you to identify any changes or inaccuracies, ensuring that your credit remains in good standing for future financial endeavors.

65. Participating in Financial Workshops:

- Attend financial workshops or webinars focused on topics such as budgeting, debt management, and smart financial practices. These educational opportunities can provide valuable insights and strategies for maintaining financial health.

Future-Proofing Your Car Purchase

66. Technology Integration in Vehicles:

- Consider the technology features of the vehicle, not just for convenience but also for potential future enhancements. As technology evolves, having a car with upgradable or adaptable features can contribute to the long-term value of your purchase.

67. Resale Value and Future Market Trends:

- Research the expected resale value of the vehicle based on historical data and market trends. Vehicles with strong resale value can be advantageous when it comes time to sell or trade in for a new model.

Government Incentives and Subsidies

68. Electric Vehicle (EV) Incentives:

- If you’re considering an electric vehicle, research government incentives and subsidies available in your region. Many governments offer tax credits or rebates to encourage the adoption of environmentally friendly vehicles, reducing the overall cost of ownership.

69. Hybrid Vehicle Advantages:

- Explore advantages specific to hybrid vehicles, such as potential tax incentives and access to carpool lanes. Some regions provide special perks for hybrid owners as part of their commitment to promoting fuel-efficient options.

70. Alternative Fuel Vehicle Credits:

- Investigate credits available for vehicles using alternative fuels, such as hydrogen or natural gas. These credits can contribute to cost savings and may vary based on local or national government programs.

Vehicle Choice and Insurance Rates

71. Insurance Considerations for High-Value Cars:

- Understand how the choice of vehicle impacts insurance rates. High-value cars often come with higher insurance premiums. Factor in insurance costs when selecting a vehicle to align with your budget.

72. Safety Features and Insurance Discounts:

- Consider vehicles equipped with advanced safety features. Many insurance providers offer discounts for cars with features like anti-lock brakes, airbags, and collision avoidance systems, contributing to potential insurance savings.

73. Impact of Vehicle Theft Rates:

- Check vehicle theft rates for the models you’re considering. Some cars have higher theft rates, leading to increased insurance costs. Prioritize vehicles with lower theft rates to potentially reduce insurance premiums.

Maintaining the Value of Your Financed Vehicle

74. Regular Maintenance Records:

- Keep detailed records of regular vehicle maintenance. Having a well-documented maintenance history can enhance the resale value of your financed vehicle, showcasing responsible ownership and care.

75. Use Genuine Replacement Parts:

- Opt for genuine replacement parts when repairs are needed. While aftermarket parts may be cheaper, using original equipment manufacturer (OEM) parts can contribute to the overall reliability and resale value of your vehicle.

76. Avoiding Modifications with Limited Appeal:

- Be cautious with vehicle modifications that have limited appeal. While personalizing your car can be enjoyable, modifications that deviate significantly from the standard features may impact the broader market’s interest and resale value.

Financial Planning for Milestone Events

77. Planning for Major Life Changes:

- Consider the potential impact of major life changes on your car financing. Events such as marriage, relocation, or the addition of family members may necessitate adjustments to your budget and overall financial plan.

78. Adjusting Loan Terms:

- If faced with unexpected changes in your financial situation, explore options for adjusting your loan terms. Some lenders may offer flexibility in modifying repayment plans to accommodate your evolving circumstances.

Final Tips for Long-Term Financial Success

79. Leveraging Loyalty Programs:

- Explore loyalty programs offered by manufacturers or financial institutions. Loyalty programs may provide benefits such as discounted interest rates, extended warranties, or special financing terms for repeat customers.

80. Regularly Reviewing Financing Terms:

- Make it a habit to periodically review your car financing terms, especially if market conditions or your financial situation changes. Refinancing or adjusting your loan terms can be strategic moves to optimize your financial position.

Lease-to-Own Considerations

81. Understanding Lease Buyout Options:

- If you’re exploring lease-to-own options, understand the lease buyout process. Some leases allow you to purchase the vehicle at the end of the lease term. Evaluate the residual value and negotiate favorable buyout terms if you intend to keep the car.

82. Comparing Lease and Loan Costs:

- Compare the total costs of leasing versus financing. While leasing may offer lower monthly payments, financing provides ownership benefits and the potential for long-term cost savings. Assess your priorities and financial goals to determine the most suitable option.

83. Flexibility in Lease Terms:

- Negotiate flexibility in lease terms. Some leases allow for modifications, such as adjusting mileage limits or extending the lease period. Understanding and negotiating these terms can provide greater control over your financial commitment.

Negotiating with Dealerships

84. Research Dealer Incentives:

- Research manufacturer incentives and dealer promotions. Dealerships often offer special financing rates, cashback incentives, or rebates. Being aware of these incentives empowers you to negotiate more effectively for a better overall deal.

85. Timing Your Purchase:

- Consider timing when negotiating with dealerships. End-of-month or end-of-year periods, when dealers aim to meet sales quotas, may present opportunities for more favorable terms. Additionally, shopping during slower seasons might lead to better deals.

86. Separating Price Negotiation from Financing:

- Separate negotiations for the vehicle price from discussions about financing. By negotiating the price first, you have a clearer understanding of the true cost of the car before discussing financing terms. This approach can enhance your bargaining position.

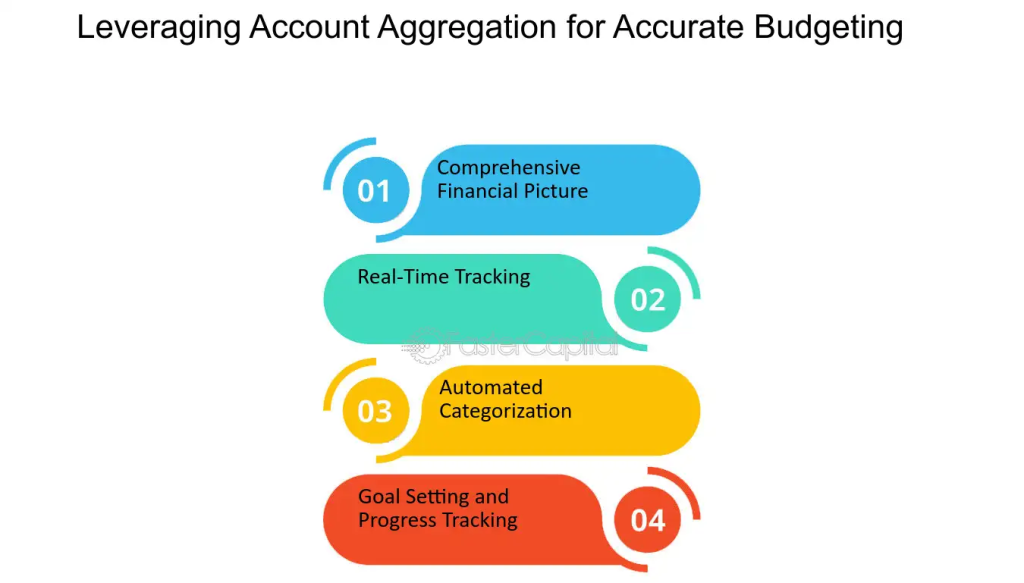

Leveraging Financial Tools for Budgeting

87. Auto Loan Calculators for Affordability:

- Use auto loan calculators not only for initial comparisons but also for ongoing budgeting. These tools can help you assess the affordability of your loan, taking into account changes in interest rates, down payments, or loan terms.

88. Budgeting Apps for Loan Repayment:

- Incorporate budgeting apps into your financial management strategy. Many apps offer features for tracking expenses, setting savings goals, and managing loan repayments. This can enhance your overall financial awareness and discipline.

89. Automatic Payments for Consistency:

- Set up automatic payments for your car loan. Automating payments ensures consistency and reduces the risk of missed deadlines. Some lenders may also offer interest rate discounts for borrowers who opt for automatic payments.

Exploring Financial Assistance Programs

90. Military and First Responder Programs:

- If you are a military member or first responder, explore financing programs tailored to your profession. Many manufacturers and lenders offer special financing incentives and discounts as a gesture of appreciation for your service.

91. Educational Employee Benefits:

- Check if your employer offers any educational employee benefits related to auto financing. Some companies have partnerships with lenders that provide exclusive rates or financial education resources to employees.

92. Community Assistance Programs:

- Investigate community assistance programs that support affordable car ownership. Non-profit organizations and community groups may offer resources, workshops, or even low-interest loans to assist individuals in securing reliable transportation.

Preparing for Resale or Trade-In

93. Maintaining Detailed Service Records:

- Maintain a comprehensive record of service and maintenance. Detailed records enhance the perceived value of your vehicle when it comes time to sell or trade it in. This transparency reassures potential buyers about the car’s history.

94. Detailing and Regular Cleaning:

- Regularly detail and clean your vehicle. A well-maintained and clean car not only enhances your driving experience but also contributes to a positive first impression, potentially increasing the resale or trade-in value.

95. Researching Future Models:

- Stay informed about upcoming models and their expected impact on the resale value of your current vehicle. Knowing the market trends and consumer preferences can guide your decisions on when to sell or trade in for maximum value.

Final Strategies for Long-Term Success

96. Building Positive Lender Relationships:

- Foster positive relationships with lenders. Maintaining open communication, meeting financial obligations responsibly, and seeking assistance when needed can contribute to a positive standing with lenders, potentially leading to better terms in the future.

97. Continuous Learning and Adaptation:

- Embrace a mindset of continuous learning and adaptation. The financial landscape and automotive industry evolve, and staying informed allows you to adapt your strategies, leverage new opportunities, and make informed decisions throughout your car ownership journey.

98. Networking with Financial Advisors:

- Consider networking with financial advisors for personalized guidance. Financial professionals can provide tailored advice based on your unique financial situation, helping you navigate complex decisions and optimize your car financing strategy.

99. Participating in Car Ownership Communities:

- Engage with car ownership communities or forums. Sharing experiences and insights with fellow car owners can provide valuable perspectives, tips, and recommendations, fostering a sense of community and shared knowledge.