Introduction

Cryptocurrencies have gained massive popularity in recent years, and two names stand out among the rest — Bitcoin and Ethereum. While both are decentralized and built on blockchain technology, they serve different purposes and function in unique ways.

In this post, we will break down the difference between Bitcoin and Ethereum in simple terms to help beginners understand how they work, how they are similar, and most importantly, how they differ.

If you're planning to invest or simply curious about crypto, this comparison will guide you toward making an informed decision.

What is Bitcoin?

Launched in 2009 by an anonymous individual or group under the name Satoshi Nakamoto, Bitcoin is the first cryptocurrency in the world.

Primary Purpose

Bitcoin was created as a decentralized digital currency — a peer-to-peer system for transferring value without relying on a central authority like banks.

Key Features of Bitcoin:

-

Limited supply: Only 21 million BTC will ever exist

-

Used mainly as digital gold or a store of value

-

Focuses on security and immutability

-

Slower transaction speed compared to modern blockchains

What is Ethereum?

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a blockchain platform that enables developers to build decentralized applications (dApps) using smart contracts.

Primary Purpose

Ethereum goes beyond digital money. It is designed to be a programmable blockchain, allowing for automation, token creation, NFTs, and DeFi (Decentralized Finance).

Key Features of Ethereum:

-

Supports smart contracts for building dApps

-

Native token: Ether (ETH)

-

Larger ecosystem including DeFi, NFTs, gaming, and more

-

Transitioned to Proof-of-Stake with Ethereum 2.0

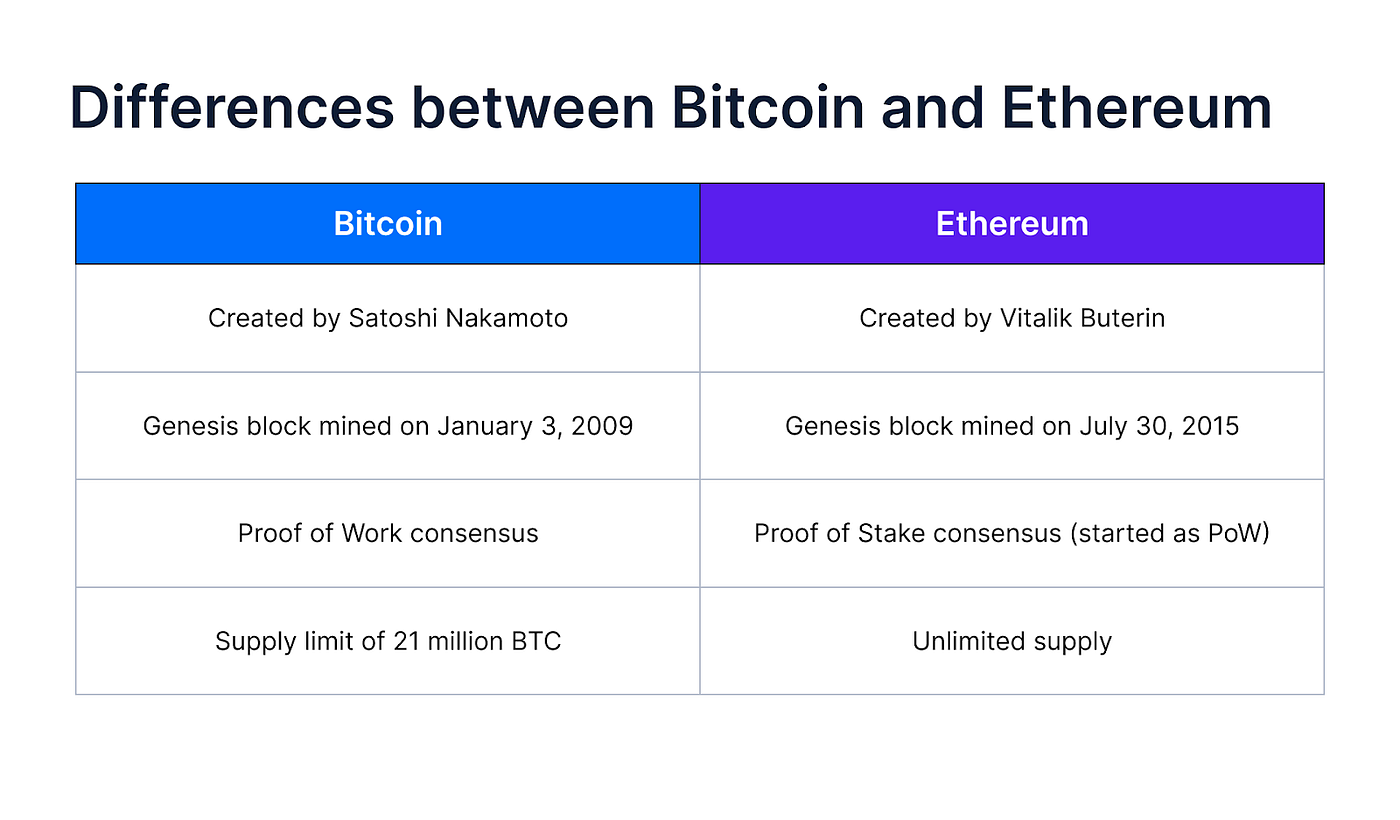

Side-by-Side Comparison: Bitcoin vs Ethereum

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Founder | Satoshi Nakamoto | Vitalik Buterin |

| Purpose | Digital currency | Decentralized application platform |

| Supply Limit | 21 million | No fixed supply (inflationary) |

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS - ETH 2.0) |

| Block Time | ~10 minutes | ~12 seconds |

| Smart Contracts | Not supported | Fully supported |

| Main Use Case | Store of value, transactions | dApps, DeFi, NFTs, contracts |

Key Differences Explained

1. Purpose and Use Case

-

Bitcoin is mainly a currency and store of value.

-

Ethereum is a development platform that supports custom tokens and decentralized applications.

2. Smart Contract Functionality

-

Bitcoin does not support smart contracts natively.

-

Ethereum is theleader in smart contract platforms, used by thousands of developers.

3. Speed and Scalability

-

Ethereum has faster transactions and is constantly upgrading (like ETH 2.0).

-

Bitcoin is slower but considered more stable and secure.

4. Supply and Tokenomics

-

Bitcoin’s limited supply makes it deflationary — good for long-term store of value.

-

Ethereum’s supply is not capped, but ETH 2.0 and burning mechanisms aim to reduce inflation.

Similarities Between Bitcoin and Ethereum

Despite their differences, both share some core blockchain principles:

-

Decentralization: No central authority controls either network

-

Cryptographic Security: Transactions are verified by network participants

-

Global Access: Anyone with internet can use them

-

Open Source: Both projects are publicly maintained and improved

Which One Should You Choose?

It depends on your goal:

-

Want to store wealth or hedge against inflation? → Bitcoin

-

Want to build apps, interact with NFTs, or explore DeFi? → Ethereum

Pro Tip: Many investors hold both BTC and ETH for portfolio diversification.

Internal Links You Should Explore Next

Conclusion

Bitcoin and Ethereum are the two pillars of the crypto revolution, each with its own mission and ecosystem. While Bitcoin shines as digital gold, Ethereum unlocks the potential of blockchain beyond money. Understanding the difference between them is crucial if you're stepping into the world of crypto.

As the blockchain world grows, both BTC and ETH will continue to play vital roles in shaping the digital economy of the future.